As part of Natural Power’s technical advisory work on energy storage projects, we keep a close eye on industry trends, including market evolution in financing and utilization of incentives.

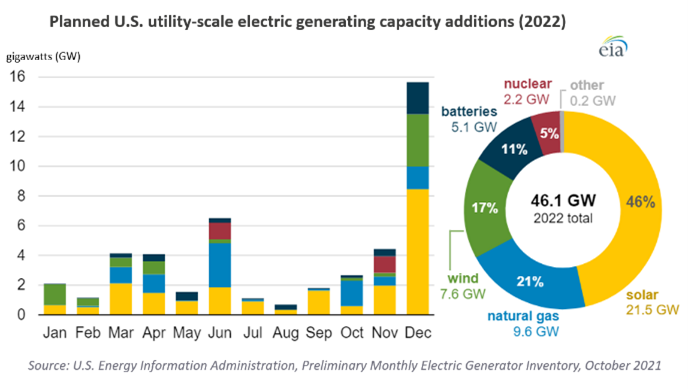

Utility-scale battery storage capacity in the United States grew from less than 1 GW in 2020 to 7 GW in 2021, projecting a growth of 5.1 GW in 2022, as seen in Figure 1.[1] According to the Wall Street Journal, several factors have driven demand, including battery cost, state storage mandates and federal incentive programs. [2] Other drivers include deploying battery storage with renewable generation and the value-add offered by regional transmission organization (RTO) markets.

The decreased cost of lithium-ion batteries from approximately $1,200 per kilowatt-hour in 2010 to below $135 in 2021 has significantly decreased costs and driven market interest in utility-scale battery storage projects. Additionally, over the next two years, the Energy Information Administration (EIA) expects the U.S. to add 46.1 GW of new utility-scale electric generating capacity, of which large-scale solar and battery storage projects will account for 32% of the new capacity additions.

Figure 1: U.S. past and expected capacity additions. Source: U.S. Energy Information Administration, Preliminary Monthly Electric Generator Inventory, October 2021.

Investment tax credit and how it affects energy storage systems as it phases out solar photovoltaic projects

As the investment tax credit (ITC) continues to phase out for solar photovoltaic (PV) projects, Natural Power is working with project stakeholders to navigate the technical and commercial factors of combining storage with solar. Along with the uncertain future of the solar ITC, it is crucial to evaluate technology advancement; declining costs of battery systems; project siting, sizing and use cases; fire safety; and the operational strategies that support net revenue estimates.

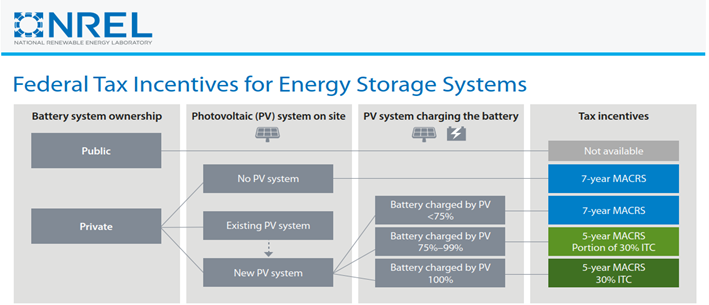

Before 2020, the ITC allowed corporate income taxpayers to claim a 30% credit for the cost of a solar project. Until January 1, 2022, a project could claim a maximum of 22%. This credit drops to 10% for all projects starting construction after that. The current state of combined solar and storage projects can be complex as the Internal Revenue Service (IRS) is vague in its description of what constitutes a storage project. As such, entities intent on claiming the ITC for their storage project must trace the point from which they derive their energy. Energy storage systems are only eligible for the ITC benefit when batteries are charged, at a minimum, more than 75% of the time by the solar system.

Battery energy storage projects and Modified Accelerated Cost Recovery System (MACRS)

Battery energy storage projects built without an installed renewable energy system can still qualify for a seven-year Modified Accelerated Cost Recovery System (MACRS). As illustrated in Figure 2, a stand-alone project could qualify for the MACRS, translating to a reduction in capital costs of about 20%.[3] For projects built with a combined PV system, there are opportunities to take advantage of both the MACRS and the ITC, depending on the percentage of time the solar project charges the storage system.

Figure 2: National Renewable Energy Laboratory federal tax incentives for energy storage systems. Source: Natural Renewable Energy Laboratory.

Storage systems charged by renewable energy less than 75% of the time will not qualify for the ITC benefit but will be eligible for the MACRS. Storage systems charged by renewable energy 100% of the time are eligible for the total value of the ITC. For storage projects that are charged between 75% and 99.9% of the time, the portion of the ITC they qualify for is equal to the percentage of the time they are charged (i.e., if renewable energy sources charge the storage project 82% of the time, they are eligible for 82% of the ITC benefit). Under the IRS code, an ITC recapture can occur if a project has been disposed of, a portion of the project has been sold, or an event that ceases the project to be eligible for the ITC occurs within the first five years of operation. The ITC vesting schedule begins when the project is placed in service, vesting 20% per year over the five-year period. If a recapture event occurs, all or part of the value of the ITC will be recuperated by the IRS based on the remaining percentage of the vesting schedule.

Keeping a storage project eligible for ITC

As the battery storage industry continues to grow, Natural Power recommends that would-be investors consider these key factors to keep the project in service eligible for ITC, thereby helping to avoid recapture events, namely:

- robust battery operational constraints and guarantees

- concise service agreements with experienced integrators and service providers

- strategies to address supply chain volatility

- flexibility in the ongoing evolution of in-state and ISO policies

- uncertainty surrounding legislation.

There could be potential delays in growth for the storage industry

The global supply chain issues have not left the storage industry unscathed, especially with the current industry practice of combined solar and storage projects comprising most upcoming, utility-scale projects. The United States’ Withhold Release Order placed on solar modules has led to widespread slowdowns in solar project development, in turn slowing down the development of storage projects. Given ITC recapture and supply chain uncertainty coupled with legislative ambiguity, growth opportunities for the storage industry could be delayed until a tax incentive system is put in place for stand-alone storage projects. Wood Mackenzie reports that interconnection queue requests have pushed past 2024 and into 2025, and notes an overall queue volume of 178% quarter-on-quarter and nearly every state seeing double-digit growth in the third quarter of 2021.[4] Battery energy storage will continue to play a significant role in the decarbonization of the U.S. power system, making communities and grid infrastructure more resilient to climate-driven extreme weather events while enabling an increasing supply of renewable energy.

Speak to Natural Power for advice on your energy storage project

Natural Power’s experience and expertise can help guide you through technical considerations in developing, financing, and constructing an energy storage project. Contact us for our industry-leading insight today.

[1] The U.S. Energy Information Administration. (2022) Solar power will account for nearly half of new U.S. electric generating capacity in 2022. [Online] Available from – https://www.eia.gov/todayinenergy/detail.php?id=50818. [Accessed: February 17, 2022].

[2] HILLER, J and BLUNT, K. (2021). Battery Storage Soars on U.S. Electric Grid. [Online] Available from – https://www.wsj.com/articles/battery-storage-soars-on-u-s-electric-grid-11640082783. [Accessed: February 14, 2022].

[3] ELGQVIST, E, ANDERSON, K, and SEATTLE, E. (2018). Federal Tax Incentives for Energy Storage Systems. [Online]. Available from – https://www.nrel.gov/docs/fy18osti/70384.pdf [Accessed February 14, 2022].

[4] Wood Mackenzie. (2021). US energy storage monitor: Q4 2021. [Online] 9 December 2021. Available from – https://www.woodmac.com/reports/power-markets-us-energy-storage-monitor-q4-2021-550456. [Accessed: 14 February 2022].