Despite the ongoing pandemic, solar PV has continued to achieve record installations. Globally, approximately 138 GW of solar was deployed in 2020, and installations are projected to exceed 160 GW in 2021.

With the end of summer and investment showing no sign of slowing down, Natural Power’s Advisory team has been reflecting on the five key trends that have dominated the solar industry in 2021 so far.

1. Module development and pricing

Waddaa Tabir, senior technical advisor

Crystalline silicon (c-SI) PV module technology continues to dominate the market and has experienced rapid technological developments over the past decades, which led to significant reductions in cost.

The increasing use of the more efficient passivated emitter and rear contact (PERC) cells has aided the rapid uptake of bifacial modules, which offer an increase in energy yield. Bifacial modules enable light to enter the cells from both the front and back of the module. While this bifacial gain is modest for sites in relatively low-irradiance regions, such as the UK and Ireland, 2021 has been the year where we’ve seen the vast majority of developers fully commit to bifacial technology.

Furthermore, C-Si modules are benefitting from developments in cell interconnection due to the development of multi-busbars (MBB) and half-cells. Both technologies allow improved module configurations and reduce resistance losses and manufacturing costs.

In addition to improved module efficiencies, manufacturers are increasingly shifting towards the use of physically larger cell and module formats, which can reduce balance of plant costs. As leading module manufacturers are starting to ship modules with a power rating of 600 W and above, developers are starting to routinely assess these large-format modules for their solar projects. It will be interesting to see to what extent production capacities for much-hyped modules such as the JA Solar 800 W Jumbo, Tongwei 780 W and Trina Solar 670W Vertex models can keep up with ever-growing demand.

Future exciting modules relating to cell architecture include the use of tandem cells that combine different semiconductors to convert different parts of the light spectrum, with the perovskite solar cell showing the greatest promise. Reported research results show that cell efficiencies using tandem architecture are approaching 30%, which commercially available solar technology does not currently achieve.[1]

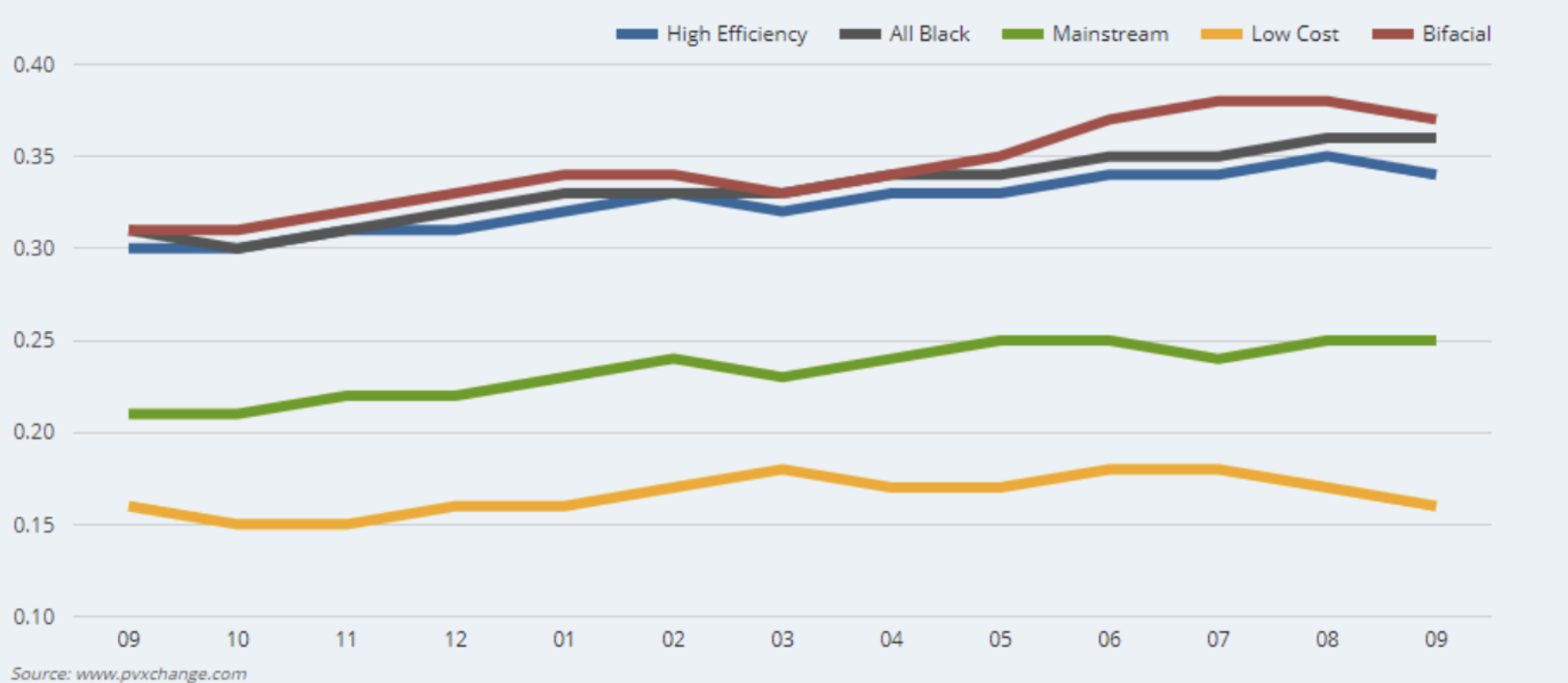

But the biggest surprise in 2021 has been that module prices have shown an uptick by as much as 20–35% compared to 2020 prices, depending on region. This is illustrated in Figure 1, which shows the average offer prices for duty paid goods on the European spot market.

Figure 1: Module price trends from September 2020 to September 2021 in EUR/Wp. Source: https://www.pvxchange.com/Price-Index

The increase in module prices is due to a complex combination of factors, including polysilicon supply bottlenecks, rising raw materials prices and higher freight rates due to Covid-19 impacts. While there’s a general consensus that module prices will continue to drop in the medium and long term, we expect to see this increased pricing volatility continue into 2022.

2. Growing interest in co-location

Andrew Cowley, solar consultant

While hybrid projects aren’t new, 2021 has seen a ramp-up in developers and asset owners who are looking to combine wind, solar and storage technologies. There are a number of reasons why co-location can be attractive, such as making the most of a grid connection, saving infrastructure costs and adding an element of flexibility. The latter is particularly relevant in markets where high penetration of renewables is starting to result in low or even negative electricity prices at times when wind and solar output is high – the so-called capture price risk.

Solar and storage remains by far the most common pairing, with the majority of solar planning applications in mature markets like the UK and US now containing provision for battery storage containers to be added. Even in markets like Ireland, where grid regulations have historically made it difficult for multiple technologies to share a connection, the first set of solar/storage hybrids have been submitted into the ECP process for securing grid capacity.

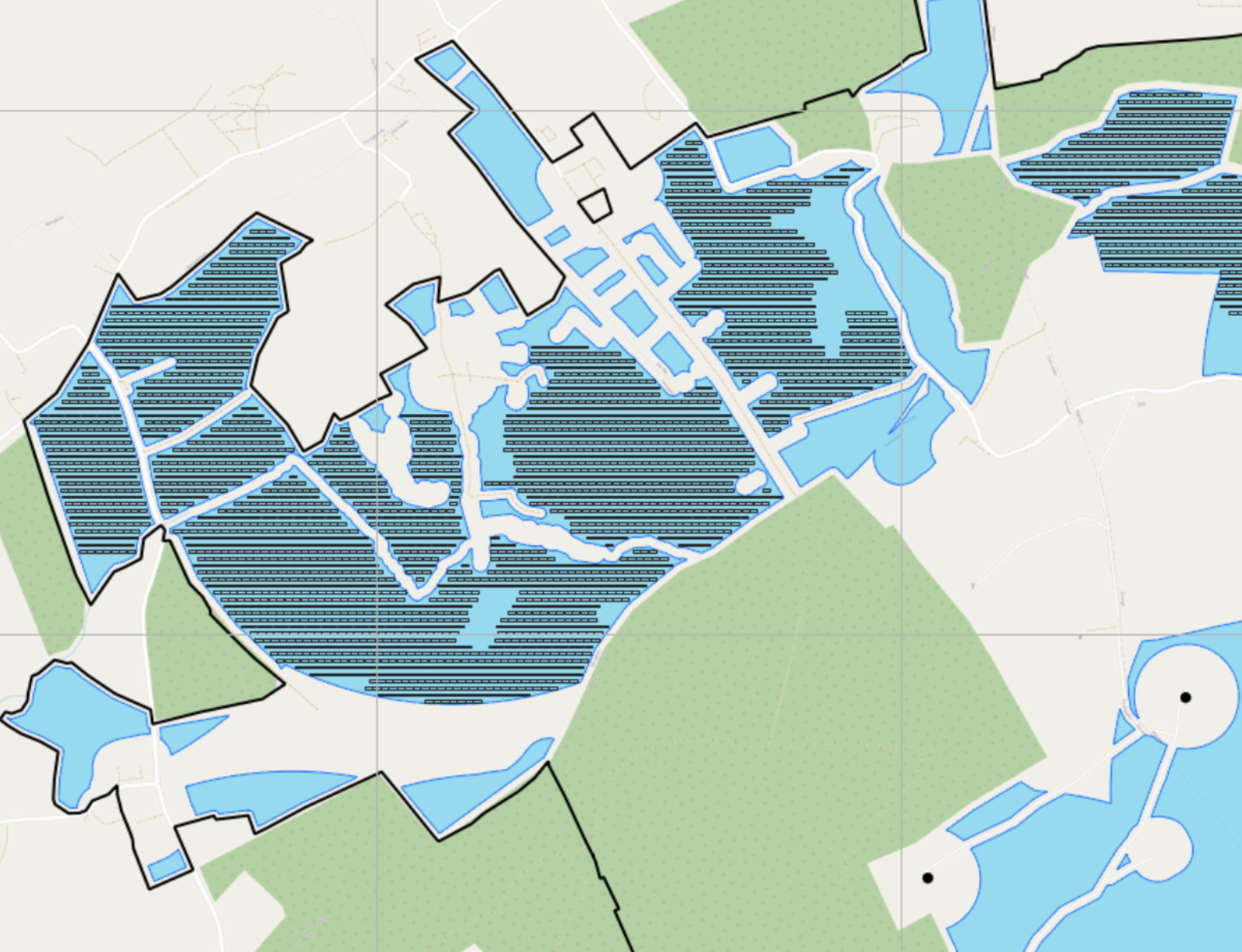

At the same time, many wind farm asset owners are looking for ways to augment their ageing sites and co-locating solar capacity can be an attractive option if the terrain allows. The complementary nature of the wind and solar resource is well understood, but the devil is in the detail when it comes to designing a hybrid site. Tower shading, ice throw risk, crane pads and access routes all need to be taken into account when determining where solar panels could be placed amongst a wind farm. We’ve even been helping developers assess the risk of a solar array impacting the wind profile at rotor height due to heating effects. An example of a hybrid wind/solar layout is shown in Figure 2.

Figure 2: Hybrid wind/solar layout example. Source: Natural Power

Finally, the market is starting to seriously grapple with long-duration storage and green hydrogen as a way of decarbonising industrial processes and certain transport applications. Portugal has emerged as a European leader in green hydrogen, announcing plans to develop a hydrogen cluster near the Port of Sines with a planned electrolyser capacity of over 1 GW. We’re also seeing a steady growth in green hydrogen development in the UK, such as the 20 MW project announced by ScottishPower that will be co-located at Whitelee wind farm.

For 2022, we expect more hybrid projects to move from the feasibility phase into detailed design and execution. And with Li-ion batteries facing long lead times and ongoing concerns around rare earth materials, we’ll be watching alternative technologies such as Zinc-ion closely.

3. High accuracy estimation of clipping losses

Dan Chawla, principal engineer

Clipping losses occur when the DC capacity of the PV system is oversized as compared with the AC capacity. Under high irradiance conditions, the DC side has to be curtailed because the AC side of the system is not able to convert all the DC power to AC power. The optimum DC:AC ratio for a project is a techno-economic calculation dependent on available site area, grid export limit, solar resource profile, energy generation profile, project costs and energy price. It varies by location and Natural Power typically sees higher DC:AC ratios in the US as compared with Europe. However, in almost all markets there is an overall trend towards higher DC:AC ratios, resulting in higher clipping losses.

Current DC:AC ratios for ground mount projects range from 1.2–1.5, with the expectation that this number may climb to 1.7+ with the introduction of bifacial modules and storage systems. High DC:AC ratios present both an engineering challenge as well as a modelling challenge for the industry. The engineering challenges associated with higher DC:AC ratios are generally related to the higher loads on the AC side of the system and the potential impact to durability of load carrying components. As an example, the useful life of an inverter is based in part on the overall loading of an inverter over the course of a day. If that load increases due to higher DC:AC ratios, it can be expected that the useful life of the inverter may decrease.

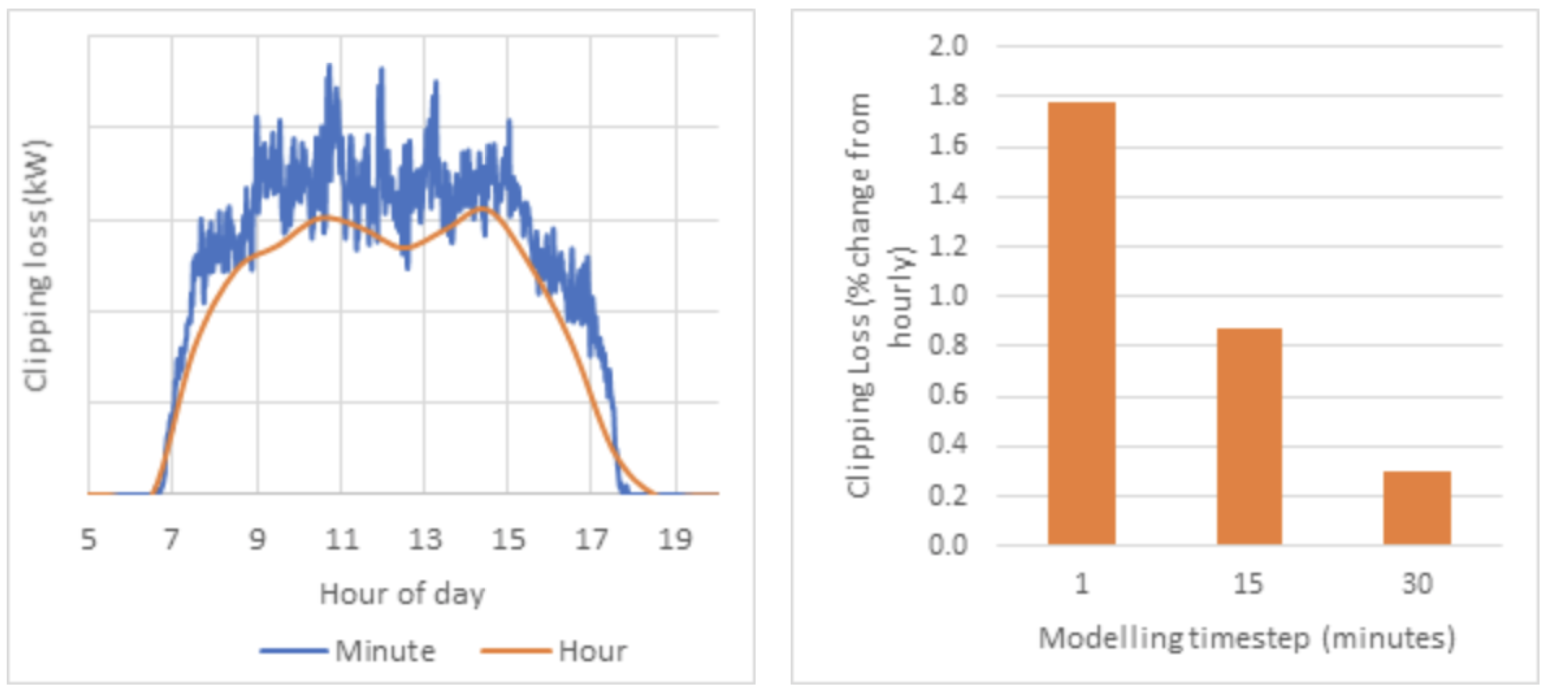

The modelling challenges associated with higher DC:AC ratios are more complex. Recent studies have shown that typical hourly modelling of photovoltaic (PV) systems may be underestimating the clipping losses by as much as 5% on an annual basis and considerably more on an hourly basis. One proposed solution is to model PV projects on a sub-hourly level in an attempt to accurately capture the clipping losses. Figure 3 shows the clipping losses from Natural Power’s own models for the same project at different timesteps and DC:AC ratio. Natural Power used one-minute ground measurement data and averaged it to larger timesteps. In general, clipping losses increase with decreasing modelling timestep.

Figure 3. Clipping losses modelled at different timesteps.

Results such as these present a problem for the industry in that it is not clear which timestep will produce the most accurate estimate of actual clipping losses at a project. Further, sub-hourly data down to the minute level is not always readily available for all project locations. Traditionally used satellite-based resource data is only able to achieve a 15-minute timestep, with some newer datasets able to achieve a five-minute timestep for the last two to three years. Some satellite providers are able to provide synthetically generated one-minute data, but it’s not clear if it’s entirely representative of ground measurements.

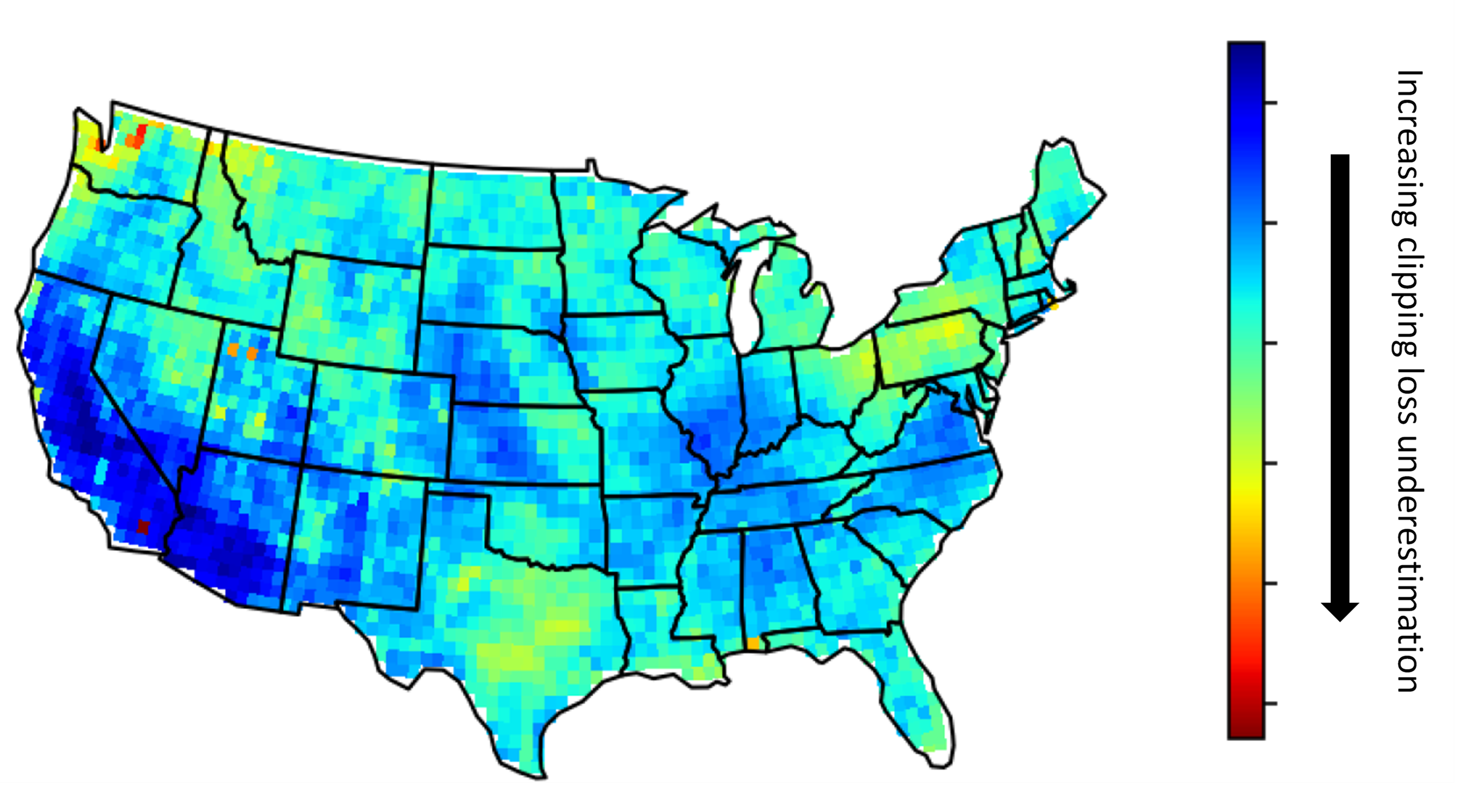

Clipping loss underestimation increases with higher DC:AC ratios and in locations with higher solar resource variability. As project designs move towards higher DC:AC ratios and the industry expands into new locations, methods to estimate clipping losses more accurately will have to be developed. As an example, Figure 4 shows the clipping loss underestimation as a function of location in the US when moving from 30-minute to one-minute data as calculated by researchers at the National Renewable Energy Laboratory.[2] In this case, the researchers correlated ground measurements with satellite data to develop a machine learning model that is able to make more accurate predictions based on five-minute satellite data.

Figure 4. Clipping loss underestimation across the US.

4. Supply chain ethics

Hannah Staab, head of advisory – Europe

After years of inaction, the solar industry is facing up to an ugly truth: a large part of the polysilicon supply chain that supports commercial solar modules is implicated in forced labour in the Xinjiang region in China. Solar industry associations including Solar Energy Industries Association (SEIA) and SolarPower Europe have published statements condemning human rights abuses and calling for increased transparency. In the US, enforcement action aimed at banning the import of solar equipment containing components provided by Chinese companies suspected of forced labour (in this case, Hoshine Silicon Industry Co. Ltd) is resulting in PV modules being detained at customs.[3] As of August 2021, this has reportedly affected several Tier 1 module suppliers, including Jinko Solar, Canadian Solar and Trina Solar.[4]

With current traceability protocols lacking detail on the silicon supply chain, it’s extremely difficult to prove that modules being shipped from Chinese suppliers do not contain materials from implicated companies. If enforcement action persists, we expect to see module suppliers scrambling to demonstrate a clean supply chain in a bid to attract buyers who are themselves facing scrutiny from shareholders and the wider public.

In the EU and UK, pressure to introduce similar legislation will likely increase ahead of the COP26 climate conference, where supply chain ethics around minerals and mining is shaping up to be a bigger focus than ever before. Fears are already being raised that over-simplified legislation against products sourced from Xinjiang will simply result in forced labour camps being moved to a different region. At the same time, it’s difficult to imagine cell and module production shifting to Europe or North America in a cost-competitive way, and this wouldn’t even begin to address the upstream supply issues.

The challenge for developers, investors and lenders is to stay on top of fast-moving developments and align on a traceability protocol that’s standardised, bankable and able to provide continued scrutiny of the PV supply chain. With shareholders and lenders ramping up scrutiny on environmental, social and governance (ESG) commitments, we hope to see the industry starting to take meaningful steps to clean up the supply chain in 2022.

5. Perovskite PV – on its way to commercial reality?

Ioannis Stylianou, senior technical advisor

Perovskite photovoltaics have been receiving increased attention over the last couple of years. But what are perovskites, and should we expect to see them deployed in large-scale solar projects soon?

The term perovskites refers to the group of materials that have a crystal structure similar to that of the perovskite mineral. Thin-film, perovskite solar PV cells were first researched in 2006; however, they’ve not attracted much commercial attention due to limitations associated to their efficiency, stability and environmental concerns due to the use of heavy, lead-based crystals. Substantial progress has nonetheless been made recently on all three fronts which, considering the low cost of perovskite materials, makes perovskite cells a technology to keep an eye on.

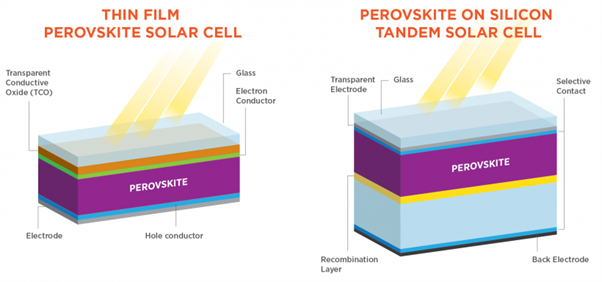

Laboratory-achieved efficiencies of perovskite solar cells reported during 2021 exceed 25%. Perovskite PV cells can also be engineered to respond differently to solar radiation of different wavelengths, paving in effect the way for tandem perovskite cells with even higher efficiencies – the highest cell efficiency officially recorded for a perovskite silicon tandem stands at 29.5%. The structure of perovskite and tandem cells is illustrated in Figure 5.

Figure 5: Perovskite cell structure. Source: https://www.energy.gov/eere/solar/perovskite-solar-cells

The stability, or useful lifetime, of perovskite cells has also improved during recent years, increasing from the scale of minutes to the scale of months. This is, admittedly, far from the 25+ year lifetimes of silicon PV modules; however, the extent of research on the matter as well as the recent improvements reported are encouraging.

In terms of chemical composition, the majority of the cell structures researched to date utilize lead halides. The toxicity and environmental impact-potential of lead, in case of leakages, is a source of concern for many and a potential threat to the acceptance of the technology itself. Methods to reduce such a possibility, such as the encapsulation of the cell utilizing self-healing polymers or the use of lead-binding coatings for absorbing any leakages, are currently being investigated. Materials such as tin are also being considered as alternatives to lead.

Full commercialization of perovskite cells is, nonetheless, not only a question of efficiency, stability and environmental constraints but also one of manufacturing scalability and bankability too. Recent news such as the completion of a 100 MW perovskite tandem cell line by Oxford PV in Germany, GCL’s expansion of its 10 MW pilot-scale perovskite module line to a 100 MW one and Jinko Solar’s announcement that it has constructed “a high-efficiency laminated perovskite cell technology platform that is expected to reach a breakthrough cell conversion efficiency of over 30% within the year” can only be interpreted as steps towards the right direction. The present signs are indeed positive, but whether perovskite cells are on their way to a full commercial reality remains to be seen.

References

[1] Physics World: https://physicsworld.com/a/tandem-solar-cells-break-new-record/

[2] ANDERSON, Kevin and Kirsten Perry. 2020. Estimating Subhourly Inverter Clipping Loss From Satellite-Derived Irradiance Data: Preprint. Golden, CO: National Renewable Energy Laboratory. NREL/CP-5K00-76021. https://www.nrel.gov/docs/fy20osti/76021.pdf

[3] Department of Homeland Security, The Department of Homeland Security Issues Withhold Release Order on Silica-Based Products Made by Forced Labor in Xinjiang. [Online] June 24, 2021. Available from - https://www.cbp.gov/newsroom/national-media-release/department-homeland-security-issues-withhold-release-order-silica [Accessed: 28 September, 2021].

[4] WAGMAN, David. (2021) Solar modules are being detained by customs agents, reports suggest. [Online] 17 August, 2021. Available from - https://pv-magazine-usa.com/2021/08/17/solar-modules-are-being-detained-by-customs-agents- [Accessed: 28 September, 2021].