Written by inspiratia with input from Natural Power's Pradeep Jayakumar, senior energy storage consultant, this article looks at how storage is undoubtedly a major asset in the road to net-zero, but can the industry go the extra mile to make it truly green across its lifespan?

There is a significant battery-shaped barrier to achieving the 1.5 degrees Celsius limit for global temperature increase. Battery storage is undoubtedly a major asset in the road to net-zero, but can the industry go the extra mile to make it truly green across its lifespan?

With transportation accounting for 23% of global emissions, there is a race to electrify the sector entirely to help meet climate targets. Meeting climate targets requires aggressive electric vehicles (EV) and, in turn, battery uptake, not to mention the battery storage requirements also needed to decarbonise the electricity grid. Given these requirements, the supply of battery materials will struggle to meet demand. This issue will likely be discussed at the 26th United Nations Climate Change Conference (COP26) in Glasgow, Scotland. Is there room for profitable battery recycling, and how can the UK ensure it takes advantage of this nascent industry?

If net-zero in the transport sector is achieved by 2050, an estimated 1.25 million EV batteries will have reached their end-of-life. Will the UK have enough battery material recovery and recycling capacity to implement circularity in the energy storage and EV industry by then?

The battery recycling industry will provide significant economic and financial opportunities if the UK encourages home-grown industrial lithium-ion (Li-ion) recycling plants. According to the Energy Innovation Centre at the University of Warwick's Warwick Manufacturing Group (WMG), as a significant vehicle market in Europe, the UK's annual sales exceeded 2.3 million units in 2019. Similarly, the Faraday Institution, an independent institute for electrochemical energy storage research based in the UK, posits that Britain needs around 140GWh worth of cell production capabilities by 2040 (567,000 tonnes of cell production and 131,000 tonnes of cathodic metals).

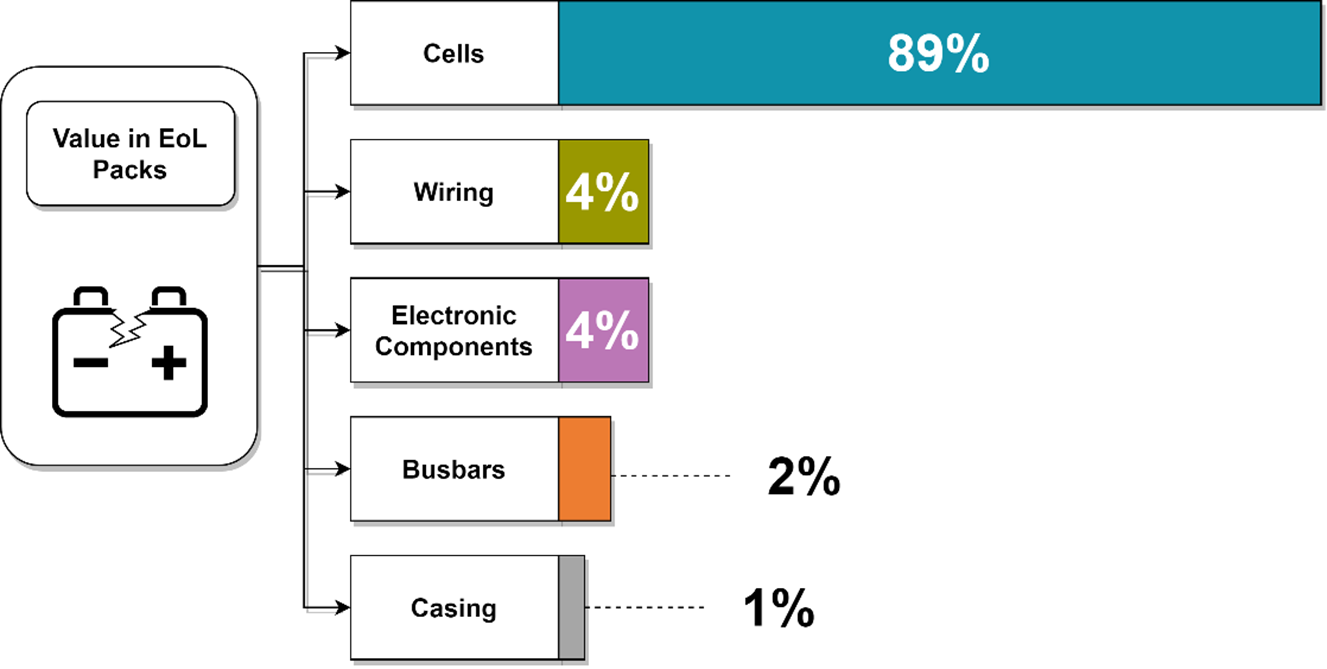

Recycling can supply about 22% of this demand, assuming a 60% recycling rate and 40% reuse and re-manufacture. The image below shows the value of the constituents of an end-of-life battery pack.

Source: Warwick Manufacturing Group - University of Warwick, inspiratia

Is there an investment opportunity?

The WMG also finds that the average value in end-of-life batteries from battery electric vehicles is £3.3 (€3.9 US$4.5) per kilogram, and UK-based OEMs are paying £3 to £8 (€3.6 – €9.5, US$4.1 – US$10.9) per kilogram to recycle end-of-life Li-ion batteries abroad. Transportation accounts for about 75% of recycling costs, which means OEMs are paying £2.25 to £6 (€2.7 – €7.1, US$3.1 – US$8.2) per kilogram alone for transport costs, particularly for batteries with damaged cells or cells in unknown conditions.

Assuming £8 (€9.5 US$10.9) per kilogram for recycling Li-ion, and a linear relationship, the transportation cost percentage for Li-ion batteries must be below 42% for OEMs to break even when neglecting overhead costs. Hence the transportation costs will have to reduce even further to see any real profit. Eliminating the need to transport spent batteries abroad will ensure cheaper recycling rates, further reducing associated carbon emissions. Encouraging investment in industry-scale Li-ion recycling operations is paramount to meeting the critical material requirements of a net-zero future. Like solar PV, it may take government intervention to get the ball rolling before economies of scale, and market forces attract private investment.

The International Energy Agency (IEA) assumes that depending on the direction of future battery chemistry, cobalt and graphite demand could experience a 6- to 30-times increase compared to 2020 levels. Additionally, rapid and successful deployment of solid-state battery technology could cause a 51-times increase in lithium demand compared to 2020 levels. Hence, battery recycling is a must to safeguard the environment and adequately meet surging resource demand.

Catching up to its peers

The UK currently lacks the industrial capacity for Li-ion battery recycling and sends batteries to mainland Europe for reprocessing, often repurchasing recovered material for future manufacturing activities. The EV industry fuels these recycling activities in mainland Europe, but recyclers must adapt to processing batteries from grid storage to meet future material recovery capacity.

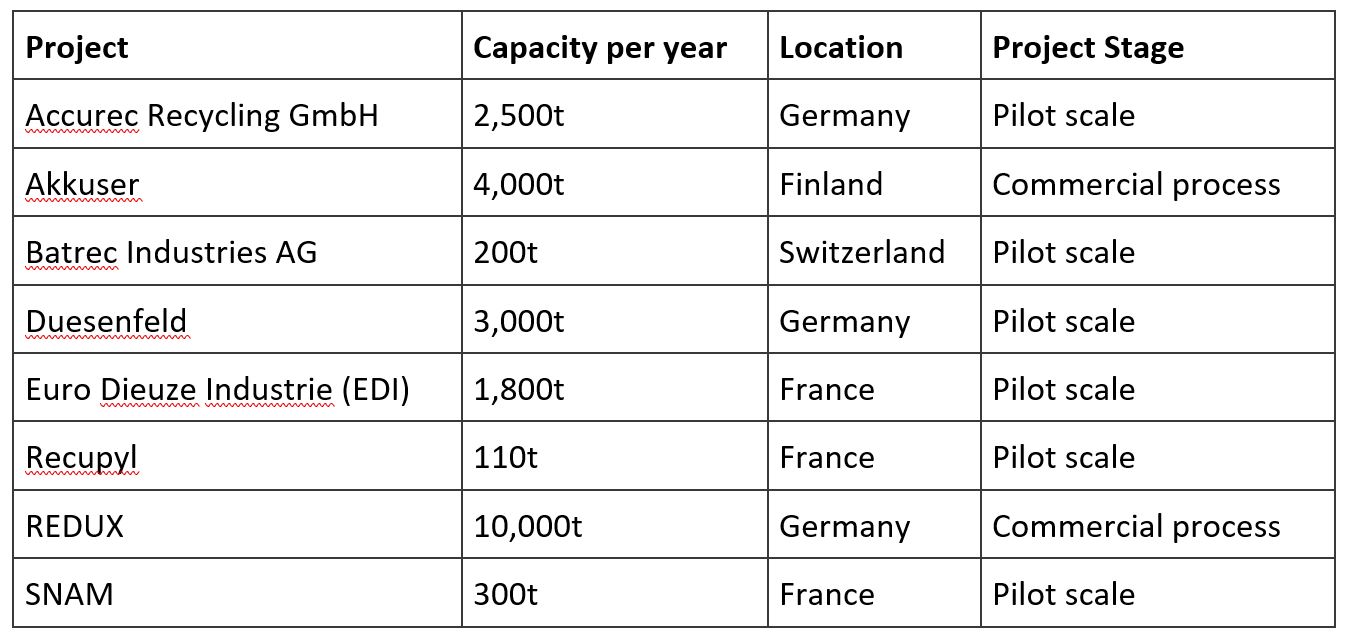

The table below shows some industry-scale battery recycling projects in Europe as part of a broader agenda to meet critical metal supply and avoid losing many of the environmental gains from EV and battery energy storage to environmental challenges arising from improper battery waste management.

Government policy must incentivise circularity

Government roles have generally covered agenda-setting and planning regarding sustainability and renewable energy, sprinkled with some innovation funding provisions. In this instance, early government agenda-setting and planning is prudent. Government must implement policies and incentives that encourage battery recycling, prioritise, and expedite planning and permitting processes for large battery recycling facilities in the UK.

Policy design should favour producers, consumers, and technology developers who promote extensive end-of-life management, including suggesting more sustainable contractual and ownership models. For instance, NIO, a Chinese automaker specialising in designing and building electric vehicles, has implemented a battery swapping plan that can save customers as much as US$10,000 (£7,344 €8,621), as customers do not own the battery but merely lease it.

Though the swapping plan intends to reduce charging times by allowing drivers to swap out batteries with fully charged ones instantly, it can have the secondary effect of extending the vehicle's life, giving the battery pack a second life for a different use-case and promoting circularity.

Regulation can be a positive force in the industry

The government can further enforce mandatory chemistry labelling requirements through regulations, enabling better and safer separation, storage, and processing of different battery chemistries. Additionally, working with the industry towards further standardisation of constituent parts can facilitate cost-effective repurposing, material recovery and recycling. Standardisation can even result in the automation of cell dismantling, which has proved very difficult to automate.

Pradeep Jayakumar, senior energy storage consultant at independent consultant and service provider Natural Power, commented on the idea of standardising battery constituents for ease of recovery and recycling.

"It is too early for standardisation because the instant you place a strict framework over it, you stop seeing evolution and innovation at the same speed. A good example is the lead-acid battery, which evolved for a very long time until arriving at a relatively standardised model." says Jayakumar.

"For Li-ion, even now we are still in the evolution and innovation stage. Even within the more established subcategories of Li-ion, there is significant innovation that takes place even today. If it were not for the automotive industry, the Li-ion battery would not be where it is today. The industry has had to evolve and innovate at a rapid rate due to the increasing popularity of EVs." He continues.

Jayakumar also indicated that if we already had a final definitive framework in place, we may not have this level of innovation. So, there should not be a standardised framework straightaway; there should be a balance where regulations exist, but in a way that does not hamper innovation and evolution.

Patient capital

Battery recycling is at the stage requiring patient and long-term capital. Such capital can often come from the public sector in the form of research grants and innovation funds. These public sector funds have historically resulted in society-changing innovation – GPS, the internet, and microprocessors – when it has acted entrepreneurial or like venture capital, but also from a very long-term time horizon. Once commercial viability is proven, private equity and venture capital can begin flowing into the technology, making it more competitive.

Though internalising the environmental and social costs of virgin mineral extraction in a battery's market price may be seen as detrimental to proliferation, it can spur recycling, recovery, and alternative battery technologies, minimising future supply chain vulnerabilities similar to the one resulting in this year's semiconductor shortage.

Developers are exploring ideas and solutions

On a positive note, industry participants are now considering the long-term environmental impacts of battery storage proliferation. They are making provisions within projects for decommissioning and disposal. However, the recycling industry will have to play catch up with an industry evolving at an astounding pace.

"We have seen projects whereby integrators of battery storage projects have decommissioning, and recycling fees included in the overall cost. They generally indicate that they will decommission the project and recycle the materials within a timeframe, like 15 years," Natural Power's Juyakumar further commented.

"However, one does not know what the recycling strategy will be even five or ten years from now. Some of our clients have asked us what they can do, which demonstrates that stakeholders are still exploring solutions," he concludes.