What was the aim of the work?

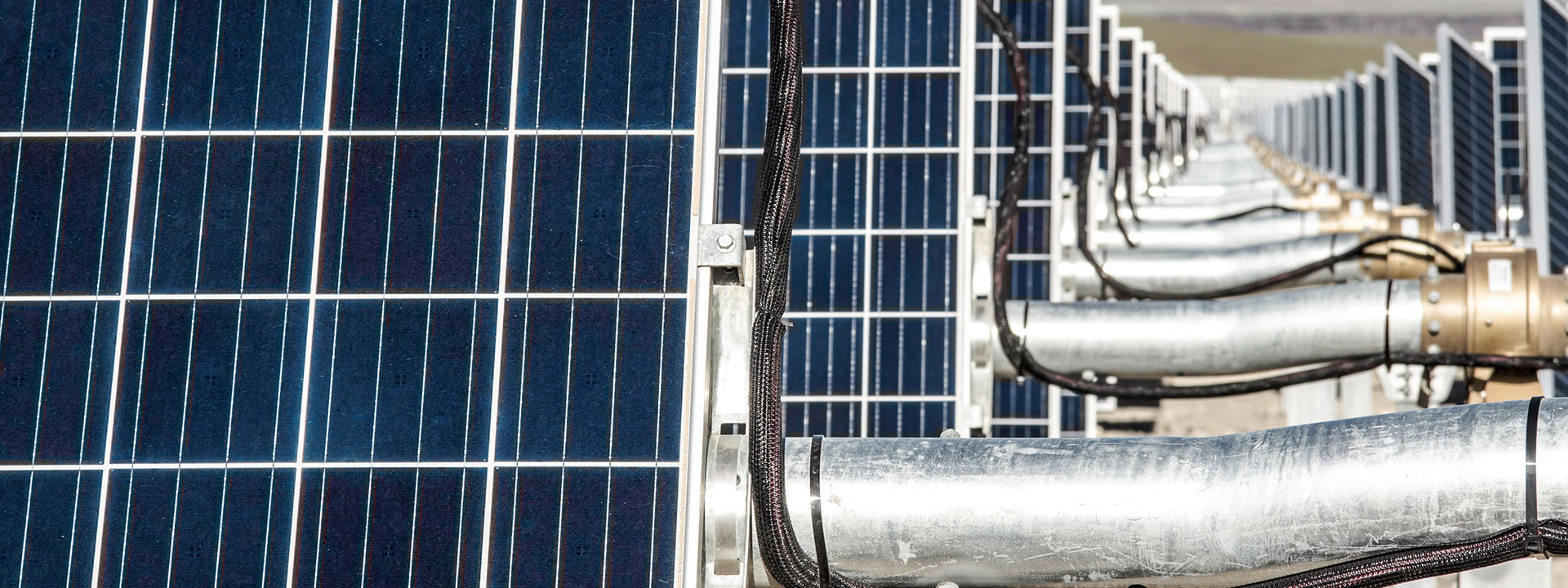

Natural Power was engaged by the French private equity specialist Crédit Mutuel Equity to provide technical due diligence to support a CHF 30 million investment in Aventron Ltd. The platform under review included a large number development-stage and operational wind farms, solar farms, rooftop solar and hydro installations in six countries.

What was the outcome?

We reviewed a large portfolio under tight timescales, focusing on key risk areas such as operational performance of the assets, assumptions regarding future build-out, and CAPEX and OPEX benchmarks. Using our pan-European experience and in-depth knowledge of the various technologies, we were able to provide our client with a general level of comfort on the portfolio, as well as allaying specific technical concerns.

What did Natural Power do to get this result?

Natural Power’s mandate for the operational sites in the portfolio included a review of technology, O&M contracts and operational performance. The team also completed post-construction yield assessments for the wind and solar assets to benchmark this against industry standard. We further assessed the historic variability of annual production. This involved a deeper dive into various upgrades that had been performed on the hydro assets. We found a fairly wide spread of operational performance across the portfolio that were linked to different contracting approaches within each region, as well as the characteristics of each technology.

For the development-stage assets within the portfolio, we focused on reviewing CAPEX estimates and future cost trend assumptions across the pipeline of wind, solar and hydro projects. This allowed our client to understand how realistic the development ambitions for the portfolio were.